Land investment in Brazil is forever.

- Oct

- 02

- Category: Invest in Brazil

What asset is forever ? When the problem is to save money from inflation, investors often see world in black and white. Some people have a strong belief, especially after recent explosions of real estate bubbles, gold and diamonds  are  only assets offering real protection from the coming financial collapse, which is always ready to strike your head and take out hard earned savings. Others believe nice transparent or colored stones and yellow metal are useless relics, which may have value only in barbarous societies.

I like the latter point of view, especially considering modern science created technologies of diamond synthesis, producing industrial diamond as expensive as $0.04 per carat. So you can order diamond powder fromChinaand have a¬† long philosophical discussion with your spouse ‚Äúare diamonds forever ?‚ÄĚ, if the most expensive exhibits differ from the cheapest ones only in size and color ?. No more value considering price difference between jewelry and industrial diamonds ! ¬†Do not forget to mention that one of biggest industrial diamond manufacturers, Element Six, belongs to De Beers, one (the only one) of the biggest diamond manufacturers for jewelry. Yet, I want to admit, gold may (hey, what are you talking, must !) retain its value because of physical characteristics and scarcity. ¬†Total extracted ¬†over the past few millennia gold deposits ¬† are roughly 155,000 metric tons. Nowadays ¬†mines supply approximately 2,600 ¬†metric tons per annum, or 1.7% of the outstanding total.

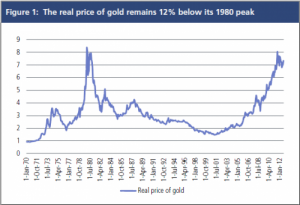

But I was not going to discuss technical or financial details of gold, currency or diamonds investments. It is common sense for investor to consider allocating gold and other precious metals to a diversified investment portfolio. Supply of these metals ¬† is constrained, while demand increases consistently with global economic growth.However, analyzing value of gold in real dollars, one may see, it’s still on the level of ¬† peak ¬†30 years ago.

The point of my discussion is that gold isn‚Äôt the only asset with the potential to hold its value in crisis times. Saying asset, I mean thing, capable to generate income or retain or increase in value for ever. This is not, for example ¬†Treasury Inflation-Protected Securities (TIPS) offering, ¬†an explicit inflation hedge. ¬†Of course, you can¬† be sure in this security in short-term perspective (let‚Äôs consider ‚Äúshort‚ÄĚ as lifespan of one generation), but what can be left for ancestors ? Values of what assets is forever ?

Let’s recall net present value principle. What the only asset is capable of generating net cash flow in perpetuity ?¬† Of course this is land. I am not going to discover America in this post, talking about land¬† value. I just want to underline two major principles in land valuation:

-  agricultural land, capable to produce high yields of highly demanded food, like wheat or sugarcane

- low risks of agriculture, which encompasses good climate(it’s warm all year round) , available water (Brazil alone has more water resources than EU) and labor (low wage expectation, ¬† loyal to employer people) resources.

Even if we forget the fact Brazil is self sufficient in oil and if we focus only on agricultural opportunities of land investments, we’ll be able to indentify¬† Brazilian land as an asset, capable to generate income in perpetuity. Let’s forget about real estate bubbles and also about the fact, that in some regions, land value have been increasing at 20% per annum. Lets think about basics and recall what basics actually are (for example, according to Maslow): food and shelter. ¬†In long term perspective value of any asset (like diamonds) will decrease alongside with its ability to facilitate human survival and successfullness. ¬†Agricultural land is the only such asset, asset forever.

- Close to the beach

- In the mountains

- Top choices

- Life in Brazil

- Invest in Brazil

- Why Brazil

- Visa for Brazil

Archives

- January 2024

- April 2019

- February 2016

- December 2015

- July 2015

- June 2015

- May 2015

- April 2015

- February 2015

- March 2014

- January 2014

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012